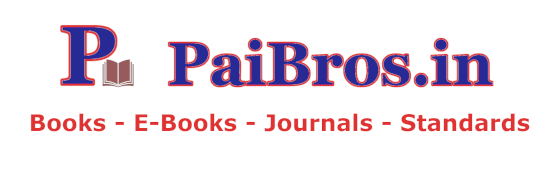

Electricity Marginal Cost Pricing : Applications in Elccations in Eliciting Demand Responses

Original price was: ₹7,716.14.₹6,172.91Current price is: ₹6,172.91.

ISBN: 9780123851345

Author/Editor: M Greer

Publisher: Elsevier

Year: 2012

1 in stock (can be backordered)

Description

Packed with case studies and practical real-world examples, Electricity Marginal Cost Pricing Principles allows regulators, engineers and energy economists to choose the pricing model that best fits their individual market.

Written by an author with 13 years of practical experience, the book begins with a clear and rigorous explanation of the theory of efficient pricing and how it impacts investor-owned, publicly-owned, and cooperatively-owned utilities using tried and true methods such as multiple-output, functional form, and multiproduct cost models. The author then moves on to include self-contained chapters on applying estimating cost models, including a cubic cost specification and policy implications while supplying actual data and examples to allow regulators, energy economists, and engineers to get a feel for the methods with which efficient prices are derived in today? challenging electricity market.

A guide to cost issues surrounding the generation, transmission, and distribution of electricity

Clearly explains cost models which can yield the marginal cost of supplying electricity to end-users

Real-world examples that are practical, meaningful, and easy to understand

Explans the policy implications of each example

Provide suggestions to aid in the formation of the optimal market price

Additional information

| Weight | 0.58 kg |

|---|

Product Properties

| Year of Publication | 2012 |

|---|---|

| Table of Contents | Table of Contents Preface Acknowledgements Chapter 1. Introduction Introduction Competitive Paradigm Marginal Cost Pricing Doctrine A Brief Overview of the United States Electric Market Objective Functions: The Players Reducing Carbon Emissions Regulation of Investor-Owned Electric Utilities in the United States Internalizing the Cost of Reducing Carbon Emissions Optimal Rate/Tariff Design and Tax Credits to Promote Efficient Use of Energy and a Reduction in Carbon Emissions Tariff Design and Rate-Making Issues Conclusion Chapter 2. The Theory of Natural Monopoly and Literature Review The Natural Monopoly Conundrum Defining Natural Monopoly Economies of Scale Efficient Industry Structure Conclusion Chapter 3. U.S. Electric Markets, Structure, and Regulations Introduction The U.S. Electric Industry Structure Deregulation Market Participants Vertically Integrated Model Industry Restructuring and the Competitive Electric Market Regulation of the Electric Utility Industry Looking Forward: Renewable Resources and Generating Technologies Future of the Electric Industry Chapter 4. The Economics (and Econometrics) of Cost Modeling General Cost Model The Econometrics of Cost Modeling: An Overview A Brief History of Cost Models and Applications to the Electric Industry Conclusion Appendix Chapter 5. Cost Models Introduction Determination of an Appropriate Objective Function: A Brief Overview of the Literature Rural Electric Cooperatives Differences between Coops and IOUs Literature Review: Cost Studies on Rural Electric Cooperatives Data Review of the Literature: Cost Function Estimation in the Electric Utility Industry Nerlove? Cobb?ouglas Cost Model Further Considerations End of Section Exercises: Basic Cost Model versus Nerlove Cost Model Flexible Functional Forms Translogarithmic Cost Function Cost-Share Equations A Priori Expectations Discussion of Estimation Results: Single-Output Translog Cost Equation Substitution Elasticities among Inputs: Hicks?llen Partial Elasticities of Substitution Price Elasticities Homotheticity End of Section Exercises: Translogarithmic Cost Function Multiproduct Cost Functions Literature Review Multiproduct Cost Models Multiproduct Cost Concepts (Revisited) Product-Specific Economies of Scale Quadratic Cost Functions A Properly Specified Quadratic Cost Function Reasons That the Quadratic Form Is the ?est?Suited for Modeling Industry Structure End of Section Exercises Cubic Cost Models Multiple-Output Models More Complex Multiple-Output Models Other Issues Measures of Efficiency for Multiple-Output Models Ray Cost Output Elasticity Degree-of-Scale Economies Product-Specific Economies of Scale Economies of Scope Cost Complementarity Conclusion End of Section Exercises: Multiple-Output Cost Models Appendix: Generalized Method of Moments (GMM) Appendix: Proofs Chapter 6. Case Study Introduction Theory of Efficient Pricing Study Design Reasons that Cooperatively-Owned Utilities Are Different Literature Review Estimating Cost Models Data Cost Models Estimation Results Efficiency Measures Discussion of Figure 6.4?verage Incremental Cost and Marginal Cost General Implications of Estimation Results Conclusion Appendix A: Panel Data Appendix B: Heteroscedasticity-Consistent Covariance Matrix Estimation Chapter 7. Case Study Cobb?ouglas Cost Model Elasticities of Substitution for Cobb?ouglas Translogarithmic Cost Function Substitution Elasticities for the Translog Form: Hicks?llen Partial Elasticities of Substitution Price Elasticities Generalized Leontief Cost Function Empirical Estimation Iterated Zellner-Efficient Estimator Generalized Leontief Cost Function?lasticities Quadratic Cost Model Nonlinear Quadratic Cost Model Elasticities Morishima Elasticities of Substitution Conclusion Appendix: Quasiconcavity in Input Prices Chapter 8. Efficient Pricing of Electricity Introduction Theory Of Efficient Prices Debate on the Optimal Pricing of Electricity: A Brief History Rate Design More About Rate Design: In Theory Overview of Rate Design Process Efficient Public Utility Pricing Ramsey Prices: A Second-Best Option4 Ramsey Pricing?he Second-Best Option Another Option: Average Cost Pricing Two-Part Tariffs Two-Part Tariff with Different Customer Classes Multipart Tariffs Nonuniform Pricing: Block Rates Time-of-use Rates A Brief History of Time-Of-Use Pricing Real-Time Pricing Understanding Electric Utility Customers Assessment of Rate Structure Options Conclusion Chapter 9. Price and Substitution Elasticities of Demand: How Are They Used and What Do They Measure? Introduction Price Elasticity of Demand A Brief Review of the Literature: Energy Demand, Elasticities Of Demand In Energy Markets, And Functional Forms Price And Substitution Elasticities Dynamic Models Structural Models Expenditure System Models Econometric Issues: Identification and Systems Bias Simultaneous Equations Consistent Parameter Estimation More Advanced Estimation Methods Additional Econometric Issues (Berndt, 1991) A Brief Survey of the Literature: Price Elasticity of Demand Substitution Elasticities Federal Legislation Technology?he ?mart Grid?How It Works Elasticities More Complex Models: Price And Substitution Elasticities Using Constant Elasticity of Substitution Model Overview of Results?aruqui And Sergici Study Conclusion For Interested Readers Recommended Reading Chapter 10. Time-of-Use Case Study Introduction The Electricity Crisis: Summer 2000 Chapter Overview Literature Review Effect of Time-Of-Use Pricing On Peak Utility Load Recent Experience in California The California Debacle: A Decade Later Using Real-Time Pricing to Estimate Price Elasticity of Demand Further Implications of the Residential Responsive Pricing Pilot Peak-Load Pricing Substitution Elasticities Elasticities of Substitution Conclusion Recommended Reading References |

| Author | M Greer |

| ISBN/ISSN | 9780123851345 |

| Binding | Hardback |

| Edition | 1 |

| Publisher | Elsevier |

You must be logged in to post a review.

Reviews

There are no reviews yet.